Mortgage applications dip, VA demand cools | Atlanta

What Changed:

-

Mortgage applications fell 1.4% week over week, unadjusted down 2%.

-

VA applications dropped about 16% for the week, and the VA share slid to 13.4% from 14.2%.

-

Refinance activity fell 3% week over week, refi share eased to 46.1% from 46.5%, yet stayed 23% higher than a year ago.

-

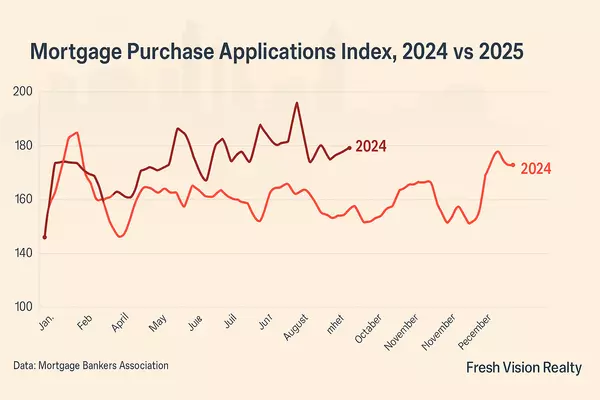

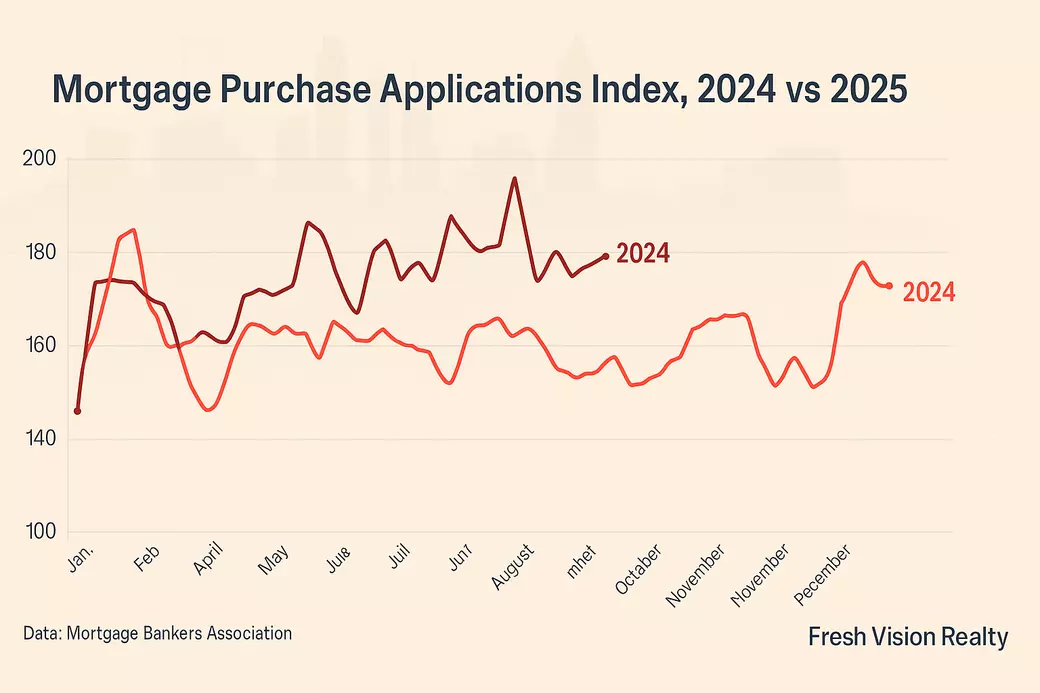

The purchase index was roughly flat on a seasonally adjusted basis, up 23% year over year.

-

Average 30-year fixed rate ticked up to 6.68%, ARM share dipped to 8.6%, and FHA share rose to 19.1%.

Mortgage applications, What it means for Atlanta buyers and sellers

If you are buying in Atlanta or Cobb County, be aware that rates could fluctuate either way. Lock when you see a favorable quote, but ask your lender about a float-down if pricing improves. For VA buyers, build strength with a full-documentation pre-approval, request seller credits to buy down the rate, and keep an FHA or conventional backup scenario in case pricing on VA remains choppy. Shop lenders on discount points, not just rate, and compare total cash to close across scenarios.

Your best offers are still coming from well-qualified purchasers, even in a mixed-rate week. Price to the most recent comp, not the peak, and structure your listing to be finance-friendly. Offer targeted concessions that lower the buyer’s payment, for example, a 2-1 buydown or closing cost credit, instead of a significant price cut. Make your home “appraisal-ready” by obtaining clear permits, maintaining receipts, and conducting a pre-list inspection, which helps prevent contracts from falling apart due to underwriting issues.

The MBA read shows a modest step back after the prior week’s jump, not a trend break. Refinance share is still high compared to last year, purchase demand is running ahead of 2024, and FHA usage is inching up as buyers chase payment relief. In Atlanta and Cobb County, there is a steady but price-sensitive market. Homes that present well and are priced within the last 30 days still move, while aspirational listings sit. Expect more conversations about concessions at the kitchen table and in the underwriting queue.

Ready to make a move in Atlanta or Cobb County, GA. Book a 15-minute strategy call with our lending Partner, Marquetta Bryant, and she will tailor your financing and pricing plan to this week’s market.

Source: HousingWire.

Categories

Recent Posts