30-year mortgage rate drops to 6.67%. Atlanta outlook

30-year mortgage rate slips to 6.67%. What it means for Atlanta and Cobb

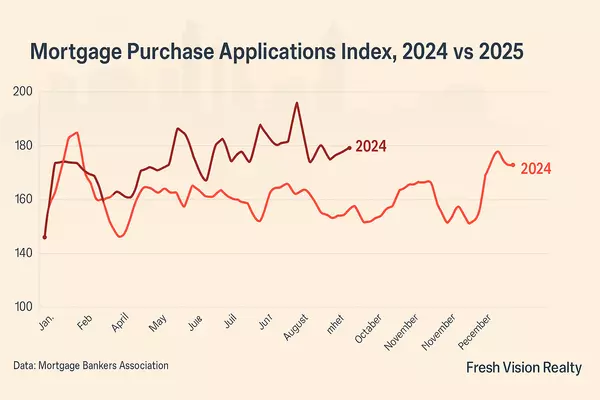

The headline this week is simple. The 30-year mortgage rate moved down to 6.67%, the biggest weekly dip since February. That kind of move catches attention across Atlanta and Cobb County because affordability, even a small notch lower, can bring sidelined buyers and potential sellers back into the game. The Mortgage Bankers Association reported the 10 basis point drop for the week ending August 8, and refinance demand jumped while purchase activity inched higher.

For context, 15-year mortgages slid under 6% for the first time in four months, matching lows not seen since October. Rates followed the 10-year Treasury yield lower after weaker employment data increased the odds of a Federal Reserve rate cut next month. Translation for our local market. Financing just got a touch easier, and confidence ticked up, even if only a little.

Refinance applications spiked 23% week over week, a sign that many owners, including Metro Atlanta homeowners who took loans in the 7s, are watching for chances to reset their payments. Purchase applications rose a modest 1.4%, which tracks what we are seeing on the ground in Cobb. More showings, more mortgage quotes, and sharper pricing conversations, especially on homes that sat through July.

Affordability is still tight. Nationally, the Realtors' affordability index is hovering near the lowest readings since the 1980s. Atlanta has outperformed many metros on job growth and new construction, yet buyers continue to run into monthly payment ceilings. That is exactly why a 10 basis point improvement matters. It can bring a few more homes into reach or shift a buyer from a temporary buydown to permanent points with the same budget.

We are also watching a subtle but helpful trend. According to brokerage data cited nationally, the income needed to afford a typical home has fallen in 11 of the 50 largest metros compared to last year. Atlanta’s mix of new construction and suburban resale options, from Smyrna to West Cobb, puts us in a position to benefit first when financing costs ease. Builders here are already using rate buydowns, closing cost credits, and design incentives to keep inventory moving, which stacks with this week’s rate dip.

How the 30-year mortgage rate move changes Atlanta math

If you are buying in Cobb County with a price point around the current median for a three-bedroom home, a 0.10% rate improvement can shave real dollars from your monthly payment. Couple that with builder incentives, and you may be able to secure a payment that seemed out of reach just a month ago. We are seeing lenders revive more aggressive lock-and-shop programs, float-down options, and targeted grant funds for first-time buyers in specific ZIP codes. None of this replaces sound budgeting. It does give you more levers to pull.

For sellers in East Cobb, Marietta, and Mableton, the key takeaway is the importance of timing. When rates step down, even modestly, more buyers schedule tours and more contingent offers resurface. If your home has been sitting, consider a refresh now. Price your listing tightly to the last 30 days, pre-inspect to reduce friction, and pair it with a lender quote sheet showing multiple payment scenarios. Payment-based marketing is effective in this environment because shoppers prioritize the monthly cost over features.

Investors across Atlanta’s west side and inside the Perimeter should watch caps and cash flow. A slight rate decline does not instantly change the cap rate math, yet cheaper financing plus softening asking rents in a few pockets can create selective buys. Focus on properties where value add is operational, not purely cosmetic, and where you can capture below-market insurance or utility efficiencies. The spread matters more than the headline rate.

On the lending side, a quick note. The MBA survey covers more than 75% of retail residential mortgage applications, which means the weekly shifts you are reading about reflect a significant slice of real borrower behavior. When refinance interest jumps by double digits, as it did this week, lenders often sharpen pricing and speed up turn times to win files. If you tried to refinance earlier this year and got quoted a rate that felt sticky, it is worth a fresh look after this week’s move.

What about the rest of 2025? No one has a crystal ball, but markets are pricing higher odds of a Fed cut if labor data stays soft. Mortgage rates track the 10-year Treasury more than the Fed Funds rate, so the bigger swing factor for Atlanta buyers is where the bond market settles. If we get a steadier downtrend into the fall selling season, watch for more move-up listings in Cobb and a bit more negotiation room to return on homes that show longer than two weeks.

Here is our local playbook right now. Buyers, get fully underwritten, not just pre-qualified. Aim for a rate lock with a float-down feature, and ask your lender to illustrate payment at today’s 30-year mortgage rate, plus and minus 0.50%. That protects you if the next data print is hot or cold. Sellers, focus on presentation and pricing to capture the first 10 days of attention, and be open to buyer credits that lower the rate instead of cutting the list price outright. It keeps your company strong while solving the payment problem buyers face.

The bottom line for Atlanta and Cobb County. The 30-year mortgage rate has just taken a meaningful step down, and while affordability remains stretched, even slight rate relief can move this market. If you paused your search or your sale earlier this summer, this is a smart moment to re-run the numbers and re-enter with a plan.

Closing CTA: Want a clear plan for your payment and your purchase or sale in Metro Atlanta or Cobb County? Send us your price range and timeline, and we will map your options with current lender programs. Contact our mortgage partner Marquetta Bryant.

Source: National Mortgage News

Summary: Mortgage rates slipped to 6.67%, the sharpest weekly decline since February, and Atlanta is already feeling the ripple. Refinance interest is up, purchase activity is nudging higher, and builder incentives pair nicely with the drop. Affordability is still tight, but this week’s move gives buyers and sellers new angles to make deals work. Fresh Vision Realty is here to translate the numbers into a plan that fits your budget and your neighborhood. Reach out when you are ready to run scenarios.

Categories

Recent Posts