Georgia deed fraud in Atlanta, protect your title

Georgia deed fraud: The Atlanta homeowner’s guide

Georgia deed fraud is real in metro Atlanta and Cobb County, and homeowners need a plan. A recent report about a Georgia couple who say a forged deed triggered a mortgage they never signed shows how quickly equity can vanish. The good news is that protection is straightforward. Turn on county recording alerts, maintain meticulous records, invest in prevention, and act quickly if anything affects your title. This guide explains what Georgia deed fraud looks like, how to spot it early, and the exact steps to keep your property secure.

Title security is not a one-time closing folder; it is an ongoing system. In Atlanta and Cobb County, you can record filings without ever stepping into an office. That convenience is excellent for real transactions; it is also why scammers try forged deeds and bogus liens. Our position is simple. Every owner should enable county filing alerts on every property, store the recorded deed and owner’s title policy in a secure cloud folder, freeze credit, and review mail monthly. For Cobb owners near East Cobb, Smyrna, and Marietta, three and four-bedroom homes are prime targets because they carry strong equity and rentability. Intown, small multifamily and condos near MARTA draw attention for similar reasons. If you keep a former home as a rental, add title monitoring to your lease-up checklist. Prevention is cheaper than cleaning up a fraud filing, and speed is everything when something looks off.

Summary

-

Deed fraud occurs when criminals forge a deed or lien to steal or borrow against your equity.

-

Early detection is your edge; set up county alerts tied to your name and parcel.

-

Keep a clean document vault, recorded deed, owner’s title policy, photo ID, and a property snapshot.

-

If an alert hits, contact the clerk, file a police report, notify your title insurer, and speak with counsel.

-

Landlords should add mid-lease exterior checks and make sure tax and utility mail reaches them directly.

Moving up in Atlanta and keeping your current house as a rental. Pair that decision with a security plan. Before you list for lease, enable filing alerts for both properties, scan your deed and owner’s title policy into a secure folder, and set calendar reminders to review any county notices. During tenant turnovers, walk the exterior, verify locks, and update your mailing address with the tax office. These small moves keep you ahead of problems and protect cash flow.

If you plan to sell in the next few months, pull your deed from the county records, confirm the legal description and current owner match your closing packet, and keep that PDF in your folder. Ask your closing attorney for an owner’s title policy if you do not already have one, then request a same-day gap search at closing to catch any last-minute filings. Add a short “post closing health check” to your checklist, review your recorded deed once the transfer posts to verify everything is clean.

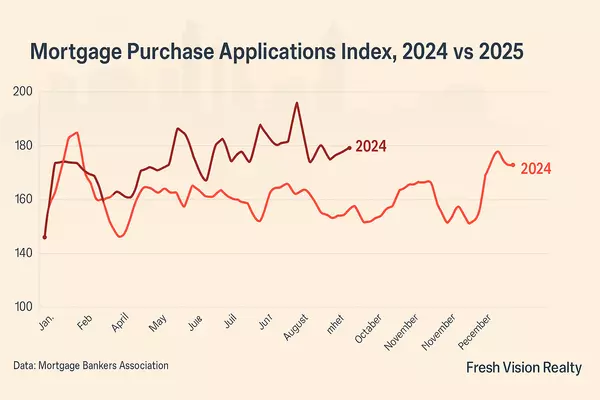

Market Context, Atlanta and Cobb County

Metro Atlanta continues to attract new residents, investors, and employers, which keeps values and equity healthy. That same momentum makes our area attractive to scammers who file forged documents against properties with high demand and low vacancy. In Cobb County, family-sized homes near top schools lease fast, so they carry solid equity and frequent ownership changes. Inside the Perimeter, neighborhoods close to job centers and transit see quick appreciation. Owners in these hot zones should prioritize alerts and documentation because activity in the index moves quickly.

Georgia deed fraud prevention checklist

Use this step-by-step plan and keep it with your property records.

-

Turn on county filing alerts for every property you own. Register by name and by parcel address so you see both name-based and property-based filings.

-

Build a secure document vault. Store your recorded deed, owner’s title policy, photo ID, mortgage payoff info, and a property snapshot with current photos.

-

Freeze and monitor credit. Add bank transaction alerts and maintain a separate email for bills and notices to avoid missing time-sensitive mail.

-

Harden the property. Smart locks, exterior lighting, and precise house numbers help during showings and inspections. Keep utilities in your name during vacancies.

-

Create a rapid response script. If an alert hits, call the clerk to flag the filing, file a police report, notify your title insurer, and contact a real estate attorney. Capture names, times, and case numbers in one note.

-

For landlords. Add mid-lease exterior checks, verify that tax bills and water bills are routed to the correct address, and schedule a quick records audit at each renewal.

Message Fresh Vision Realty and ask for our one-page Georgia deed fraud checklist. We will help you review your title documents, set up alerts, and build a 60-day security plan for your address.

Source: HousingWire

Categories

Recent Posts