Atlanta housing inventory is up. Buyers regain leverage

Atlanta housing inventory is up, and buyers finally have leverage

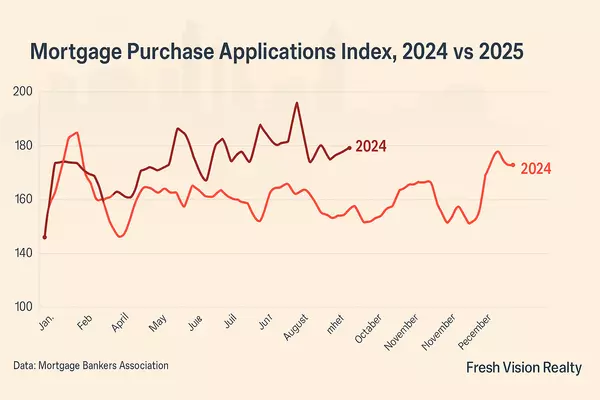

Fresh numbers from the National Association of Realtors point to a shift that Metro Atlanta buyers have been waiting for. Listings are stacking up to the highest levels since the early pandemic period, price growth is near flat in many metros, and homes are sitting longer. In plain English, Atlanta housing inventory is doing the heavy lifting to put buyers back in control. You can feel it in the conversations. More price cuts. More concessions. More sellers are willing to fix items that would have been ignored last spring.

If you have been circling the market, this is the moment to move from watching to acting. We are not calling a crash. We are calling a window. When inventory rises faster than demand, negotiating power tilts to the buy side, especially in the mid-tier of Cobb County, where move-in ready homes used to attract a dozen offers in 48 hours. Today, those listings are getting measured, not mobbed. Sharp buyers are using inspection periods, rate credits, and timing to write cleaner contracts without throwing crazy money at appraisal gaps.

How to work the Atlanta housing inventory to your advantage

Start with data from your exact micro-market. Days on market and the percentage of active listings with price reductions tell you where leverage lives. In East Cobb and West Marietta, we are seeing more homes cross the 21-day mark, a line that often triggers the first real conversation about price. Pair that with the steady trickle of new listings each week, and you get a setup where buyers can ask for what they actually need instead of settling for what they can tolerate.

Here is the playbook we are currently running for our clients.

Lead with payment, not price. Ask the seller for a permanent rate buydown or closing credit before you chase a headline price cut. A $10,000 credit can improve your monthly payment more than a $15,000 discount at these rate levels. It also helps sellers protect the neighborhood comp while still solving your payment problem.

Target the stale but solid homes. Homes that have been on for 3 to 5 weeks often have willing sellers and minor cosmetic friction. Fresh paint and lighting can change the experience for a fraction of the cost of a bidding war.

Use pre-underwriting to control the timeline. When you are fully underwritten, you can offer a faster close or a flexible lease-back, which is real currency for move-up sellers trying to coordinate two transactions.

Shop new construction with a resale mindset. Builders across Metro Atlanta are still offering closing costs, appliance packages, and sometimes permanent buydowns. Compare those all-in incentives to a resale where you can negotiate repairs and credits. Do the math both ways.

Keep your inspection rights. Rising inventory cuts the pressure to waive everything. Get the septic pumped and scoped in West Cobb. Pull the permits in Atlanta city limits. Slow is smooth, smooth is fast.

Sellers, the strategy shifts, but the goal stays the same

This is not a doom scenario for sellers. It is a reality check. If your home is dialed in, priced to the last 30 days, and professionally presented, you will still get vigorous activity. What is different is the margin for error. Miss the price by 3 percent and you can burn through your best buyers in week one. Today, smart sellers pre-inspect, stage, and bring a flyer that illustrates three monthly payment options: one at list price with a rate buydown, one with closing credits, and one with a modest price improvement. Meet buyers where they make decisions, at the monthly number.

Investors, this is your moment to get picky. Expanding inventory provides more opportunities to address operational issues that others prefer to avoid, such as insurance, utilities, or layout adjustments, rather than paying premiums for a turnkey solution. In-town, watch small multifamily and condos with longer days on market. In Cobb, monitor townhomes near job centers with sticky rent comps and comprehensive HOA coverage.

The big picture is simple. Inventory creates options. Options create negotiation. If mortgage rates drift a little lower into fall, buyers will have a rare combination of choice and slightly better payments. Sellers who adapt quickly will still win. Those who try to price it as if it were 2022 will chase the market. The Atlanta housing inventory dynamic is real and actionable right now, but it won't last forever.

Want a custom plan for your purchase or sale in Atlanta or Cobb County? Send your target payment or list price, along with your move timeline, and we will build a step-by-step strategy that fits today’s market.

Source: Chicago Agent Magazine

Summary: High, slower-moving inventory has finally given Atlanta buyers negotiating power again, from price reductions to meaningful credits. Sellers can still succeed with tight pricing and strong presentation. Fresh Vision Realty turns these conditions into a plan that respects your budget and your goals. Ready when you are.

Categories

Recent Posts