Home to rental in Atlanta, your step-by-step conversion guide

Home to rental, the complete Atlanta and Cobb County guide

Turning a residence into an income property is smart, especially in metro Atlanta. This home-to-rental guide walks you through legal prep, pricing, management, and profit tactics so you avoid rookie mistakes and maximize long-term returns. We provide localized support for Atlanta and Cobb County owners seeking steady cash flow without chaos.

In Atlanta and Cobb County, rent demand stays resilient thanks to job growth, universities, and in-migration. That demand rewards owners who treat rentals like a business. Get the property rent-ready, set a price grounded in real comps, then build a system for screening, maintenance, and renewals. In Cobb, proximity to The Battery, KSU, and I-75 boosts rents for clean, updated homes. Inside the Perimeter, walkability and transit bump value. Short-term rentals can work in narrow pockets, but local rules are strict, so most clients win with well-screened 12-month tenants and light value-add upgrades. If you want hands-off, a quality manager pays for itself with fewer vacancies and stronger renewals.

Summary

-

Prep legally first. Verify local rental permits, safety devices, and occupancy rules.

-

Make high-ROI upgrades, such as paint, floors, lighting, bath, and kitchen refreshes, and consider a smart thermostat.

-

Price with comps and adjust annually. Bake in realistic costs, management, and reserves.

-

Screen hard, document everything, and use a clear lease with fees and maintenance rules.

-

Systemize maintenance, plan for emergencies, and keep preferred vendors on call.

If you are buying your next home and keeping the current one as a rental, confirm your new mortgage’s occupancy requirements and run a rent-ready budget before closing. Aim for conservative debt coverage; your gross rent should cover mortgage, taxes, insurance, maintenance, and still leave a margin. Look for features renters pay for in Atlanta, such as fenced yards, off-street parking, in-unit laundry, and updated kitchens.

Not ready to sell in this market, rent instead, and let appreciation work while the loan pays down. Before listing for lease, capture professional photos, add a pet policy with pet rent, and price slightly under competing stale listings for fast, high-quality tenant demand. Revisit rent at renewal, add modest increases tied to market data, and clear notice timelines.

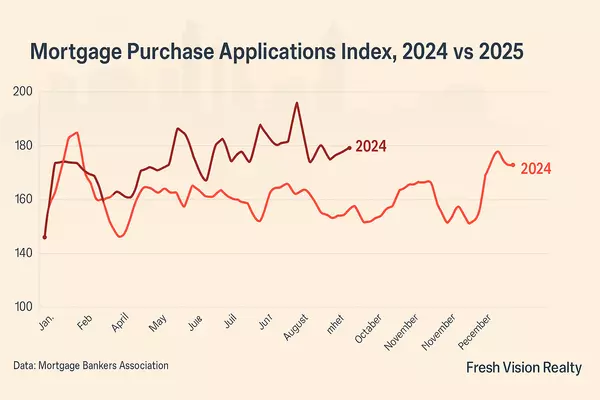

Metro Atlanta's vacancy rates trend lower than those of many Sun Belt peers, while Cobb County attracts renters seeking great schools, parks, and Braves game-day energy, all without city tax bills. Three and four-bedroom single-family homes near East Cobb, Smyrna, and Mableton lease quickly when they show well. Intown condos and townhomes tend to sell best near MARTA and job centers, such as Midtown, Buckhead, and Perimeter.

Setting the Right Price

Anchor your rate to similar size, age, and finishes within a one to two-mile radius. Note school zones in Cobb and transit access in Atlanta. Add value for garages, fenced yards, and recent renovations. Recheck annually and adjust with demand, seasonality, and renewal performance.

Tenant Screening that Protects Your ROI

Require a complete application, verify income, run credit and background checks, and call previous landlords. Red flags include chronic late payments, unverifiable income, or inconsistent stories. Use written criteria and apply them consistently.

Management, Repairs, and Reserves

Decide on self-management or hire a manager, typical fees range from 8 to 12 percent. Build an annual maintenance plan, HVAC service twice a year, gutter cleaning, pest prevention. Keep an emergency fund equal to three months of rent for vacancies and surprises.

Legal Basics for Georgia Landlords

Georgia law outlines deposit handling, notice periods, and eviction procedures. Never self-evict. Place required detectors, maintain locks, and document move-in condition with photos and a checklist. Use a Georgia-specific lease with addenda for pets, smart devices, and lawn care.

Profit Boosters

Offer in-unit laundry, energy-efficient appliances, and a smart thermostat. Consider optional lawn care or quarterly filter delivery as paid add-ons. Furnished options can work near universities or medical hubs, but turnover costs rise, so price accordingly.

Home to rental pricing and ROI, how to run the numbers

Estimate gross rent from accurate comps, subtract fixed costs, mortgage, taxes, insurance, HOA, variable costs, maintenance, vacancy, and management. What remains is Net Operating Income. Divide NOI by your total cash invested to see ROI. Target positive cash flow with a healthy reserve so repairs do not erase profits.

Text or call Fresh Vision Realty for a quick rent-ready walkthrough and pricing brief. We will deliver comps, a make-ready checklist, and a 60-day leasing plan tailored to your address.

Source: Fresh Vision Realty

Categories

Recent Posts

GET MORE INFORMATION

Broker | License ID: H-79472